In this article, we examine the Bitcoin landscape to assess whether the long-awaited bull run is already underway. The analysis is based on hard facts up to November 2023. Many are questioning whether we are in the early stages of a bull market, with Bitcoin having doubled since its low point and ETH up 2.3 times. Some altcoins have also seen significant upward movements. The question is: are we in a bull trap, or is the bull market set to continue ?

To answer this question, we explore various elements to watch out for to determine whether a sustainable bull market is possible in the near future. We have designed this analysis to be accessible, focusing on fundamentals rather than complex technical analysis.

Disclaimer: this article does not constitute investment advice. We encourage you to conduct your own research to support your convictions.

I) BITCOIN CYCLES: A KEY INDICATOR

Let’s begin our exploration by looking at cycles, a crucial indicator in the world of Bitcoin. Lasting 4 years so far, these cycles follow a sequence of accumulation, bull market, distribution and bear market. Based on this pattern, we could now be in a particular stage of this cycle, which could potentially influence the market in the coming months.

HALVING BITCOIN: AN EXPECTED EVENT

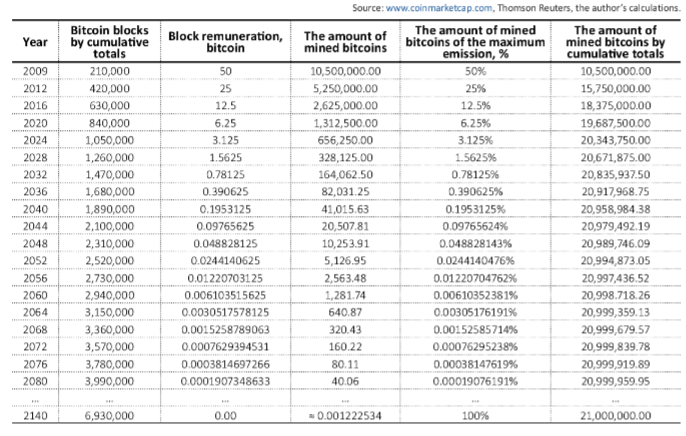

Another element to consider is the halving, scheduled for April 2024. What’s more, the event, which occurs every 210,000 blocks on the Bitcoin blockchain, halves miners’ rewards. Throughout history, halving has been closely associated with a notable rise in the market. As a result, the next expected event could potentially have a significant impact on the price of Bitcoin.

II) TECHNICAL ANALYSIS: BULL RUN

Let’s take a moment now to look briefly at technical analysis using the MVRV Z-score. Historically reliable, this indicator is currently signalling an exit from the green zone, potentially indicating the start of an uptrend. This observation, combined with other factors, reinforces the idea that we could be at the start of an intriguing move in the market.

Bitcoin Bull Run: THE GLOBAL ECONOMY AND ITS IMPACTS

Zooming in on the macroeconomy, taking into account the global context. Since the creation of Bitcoin in 2008, the economic environment has been fairly favourable for risky assets. However, recent changes in interest rate policy in the United States could influence the Bitcoin market. Rising interest rates, in response to inflation, can create both opportunities and challenges for risky assets.

III) IMPACT OF FED POLICY ON BITCOIN

The policy of the US Federal Reserve (FED) and its impact on inflation are crucial factors that require close monitoring. Recent rate hikes have the potential to influence investment behaviour and demand for risky assets such as Bitcoin.

Conclusion

While anticipated elements like halving and cycles continue to influence the market, external factors such as monetary policy and global economic changes can also play a crucial role. Remain vigilant, do your own research and adjust your strategies as the market evolves.

To find out more about our products, click here: https://quant-vision.com/blog/

If you’re interested in trading, you can find out about our training courses here: https://quant-vision.com/